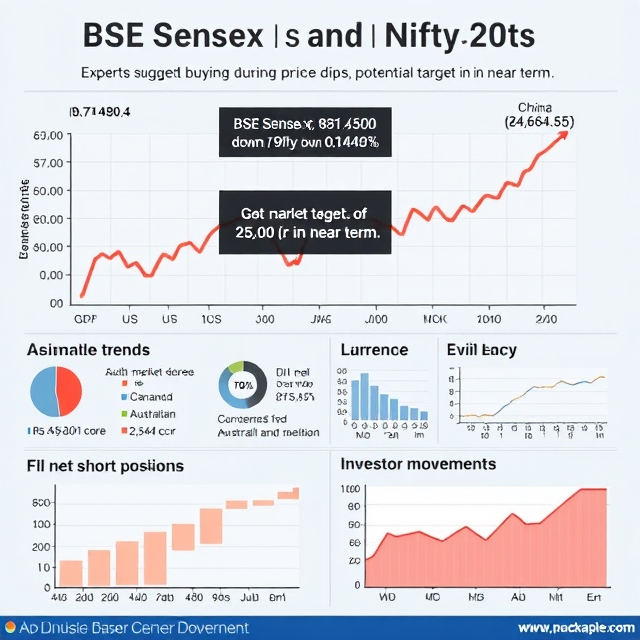

Stock Market Update: Sensex, Nifty50 Open in the Red Amid Global Economic Data Concerns

Indian equity benchmarks BSE Sensex and Nifty50 started the week on a weak note, with BSE Sensex opening over 100 points lower, while Nifty50 maintained its position above 24,650 on Monday morning.

At 9:16 AM, BSE Sensex was trading at 81,644.04, down 65 points or 0.080%, while Nifty50 was at 24,667.35, down 10 points or 0.042%.

Economic Data in Focus

This week’s market trends will likely be influenced by key economic data, including:

- US, UK, and Japan’s GDP figures

- China’s CPI (Consumer Price Index) and PPI (Producer Price Index)

- India’s CPI

Experts believe buying during market dips remains a strategic move. Analysts suggest that the market could test levels of 25,500 in the near term, as corrections following strong upward movements are seen as opportunities for investors.

Global Market Trends

Asian markets saw a decline on Monday, with South Korean equities leading the drop, ahead of several central bank meetings that are expected to ease interest rates. The US inflation data continues to hold significant weight for potential policy adjustments.

Oil Market Dynamics

Crude oil prices traded mixed during early trading in Asia, with demand concerns from China counterbalanced by rising geopolitical tensions in the Middle East following developments related to Syrian President Bashar al-Assad’s removal.

Currency Movements

Attention is focused on the Canadian and Australian dollars ahead of their respective central bank meetings, while other major currencies, including the euro, remained relatively stable as investors assessed US dollar trends.

Investor Sentiment

Foreign Portfolio Investors (FII) sold a net Rs 1,830 crore on Friday, while domestic institutional investors (DII) bought Rs 1,659 crore worth of shares. Additionally, FII net short positions were reduced from Rs 45,397 crore on Thursday to Rs 39,441 crore on Friday, indicating a shift in investor sentiment.

Market Outlook

Market experts remain optimistic about opportunities during price corrections, emphasizing that strategic buying during market pullbacks could pave the way for steady market recovery.